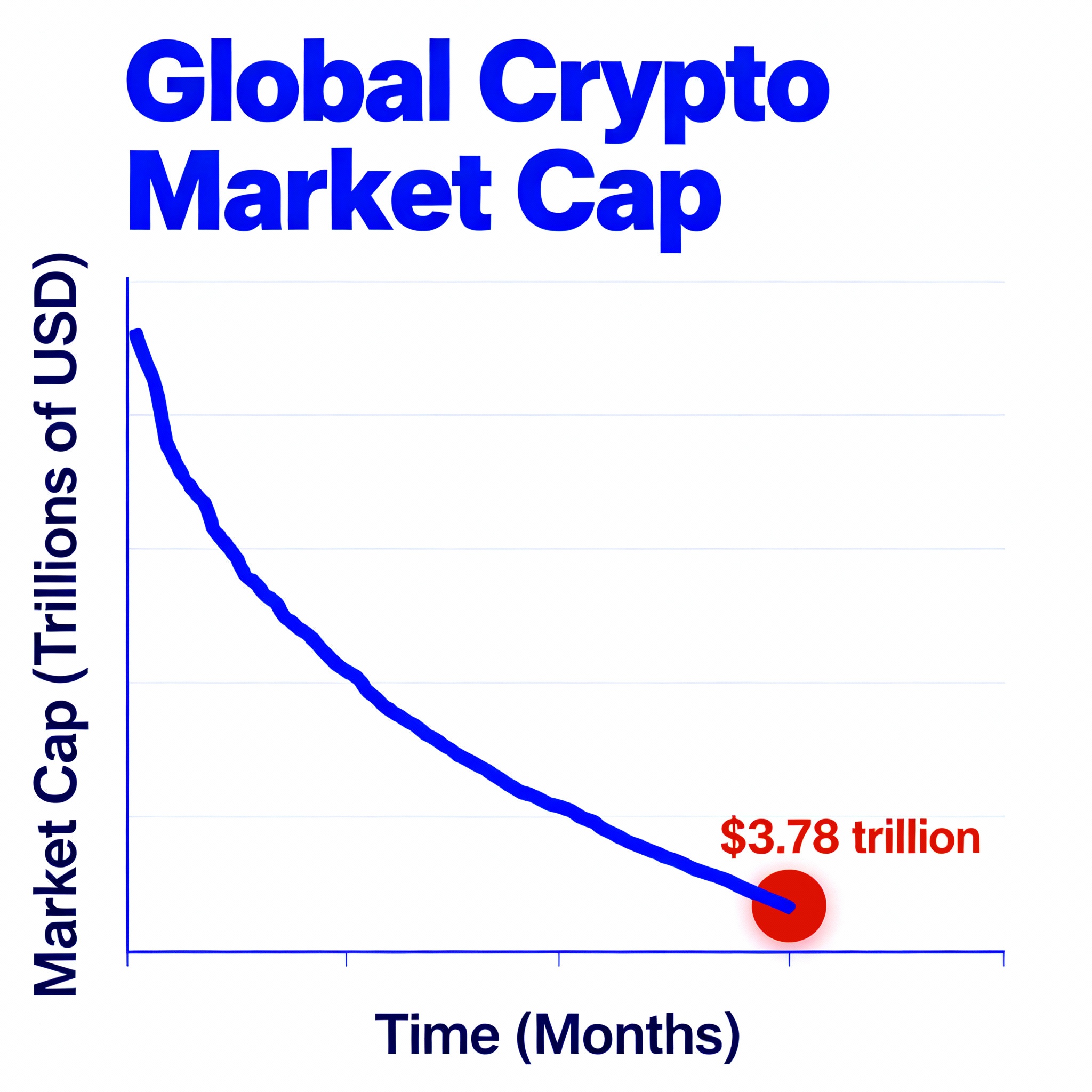

Global Crypto Market Cap Falls to $3.78 Trillion as Volumes Drop

The global cryptocurrency market has entered a period of cooling after months of high volatility and record-breaking activity. Data from major analytics platforms show that the total crypto market capitalisation has fallen to around $3.78 trillion, down nearly three percent in the past twenty-four hours. The drop coincides with lower trading volumes across leading exchanges, signalling a temporary pause in the market’s bullish momentum.

Bitcoin, which dominates nearly half of the market, slipped below $110,000. Ethereum followed the same pattern, hovering near $4,000 after failing to hold recent highs. Most large-cap altcoins, including Solana, Avalanche, and XRP, also registered mild declines. Analysts suggest that the retracement reflects a natural consolidation after months of rapid growth rather than the beginning of a prolonged downturn.

Still, falling liquidity and thinner order books have amplified price movements. With fewer active participants, even modest trades can produce significant volatility, leaving traders on alert for sudden reversals.

A Cooling Market After Months of Heat

The Data Behind the Decline

According to CoinMarketCap and CoinGecko, global daily trading volume has dropped to approximately $192 billion, compared with an average of $250 billion earlier this month. Stablecoin turnover, a key measure of liquidity, has also decreased. Tether (USDT) and USD Coin (USDC) reported smaller issuance and redemption flows, indicating reduced trading activity.

Bitcoin’s dominance ratio stands near 48 percent, showing that investors are retreating to safer assets within the crypto ecosystem. Meanwhile, the combined market cap of altcoins fell more than five percent week-on-week.

Market watchers point to reduced institutional inflows as a contributing factor. Exchange-traded products and funds that track cryptocurrencies saw net outflows last week, marking the first negative reading in over a month.

Macro Environment Adds Pressure

The slowdown in crypto volumes coincides with broader uncertainty in global markets. Investors are adjusting to central-bank policies that remain cautious despite recent rate cuts. The U.S. Federal Reserve’s message that further easing is not guaranteed has tempered risk appetite across all asset classes.

Rising Treasury yields and a stronger U.S. dollar have added further pressure. Traditionally, tighter liquidity conditions push investors toward lower-risk assets. The crypto market, often considered speculative, tends to underperform in such environments.

Additionally, geopolitical risks remain elevated. Ongoing tensions in Asia and Europe have driven investors to seek stability rather than risk exposure. As a result, trading desks report fewer large speculative positions and more hedging activity.

Traders Shift from Speculation to Caution

The mood among traders has changed dramatically since the summer rally. Many are now reducing leverage, scaling back positions, and waiting for clearer signals before committing capital. Funding rates on perpetual futures have turned neutral, suggesting that both bulls and bears are exercising restraint.

Technical indicators support the idea of consolidation. Bitcoin’s relative strength index has cooled from overbought levels, while its volatility index has begun to normalise. Analysts view this phenomenon as a healthy correction that could set the stage for a more sustainable advance later in the year.

Retail activity has also softened. Google search interest for terms such as “buy Bitcoin” and “crypto market prices” has decreased, suggesting lower speculative enthusiasm. However, wallet creation on major networks remains steady, indicating that long-term adoption continues even as short-term speculation wanes.

Institutional Perspective

Institutions remain cautiously optimistic. Fund managers at large investment firms say they are monitoring market conditions but have not abandoned digital assets. Many believe that crypto market remains an attractive diversification tool in portfolios, particularly as inflation uncertainty persists.

According to data from Greyscale and Fidelity, institutional holdings in Bitcoin and Ethereum remain stable. While inflows have slowed, outflows have not accelerated, showing that long-term investors still view the sector as strategically valuable.

Some analysts even see opportunity in the pullback. “Periods of low volume and declining prices are when smart money builds positions,” said Laura Cheng, Head of Research at Wisuno. “It presents an opportunity to amass high-quality assets at a reduced price prior to the subsequent macroeconomic boom.”

Altcoins Feel the Pinch

The decline in overall market cap has hit altcoins harder than Bitcoin. Tokens such as Solana, Cardano, and Polygon lost between four and seven percent, reflecting their higher sensitivity to liquidity conditions.

DeFi platforms have also experienced reduced activity. Total value locked across decentralised finance protocols dropped slightly to $92 billion, its lowest level in two months. Analysts attribute this decline to lower yields and reduced speculative borrowing.

NFT markets, which had seen a mild revival earlier this year, are once again quiet. Trading volumes on OpenSea and Magic Eden have decreased, and floor prices for major collections have stabilised.

Despite the slowdown, developers remain active. Many teams continue to build, launch upgrades, and secure new partnerships, suggesting that innovation in the sector is not slowing down even as prices consolidate.

Stablecoins as Liquidity Barometers

Stablecoins continue to serve as a barometer for market sentiment. When traders expect volatility, they often move funds into dollar-pegged tokens to preserve value. Over the past week, supply data show a slight contraction in major stablecoins, a sign that some capital has left exchanges for the sidelines.

This retreat is not necessarily negative. It suggests that investors are waiting for better entry points rather than abandoning the crypto market altogether. Historically, stablecoin supply tends to expand again once markets find stability, fuelled by the next wave of price recovery.

Regulated stablecoins such as USDC and PayPal USD are gaining attention as institutions demand greater transparency. The growth of compliant stablecoin models could help sustain long-term liquidity, even if short-term volumes fluctuate.

Market Sentiment: Fear or Fatigue?

The crypto fear-and-greed index, a widely used sentiment measure, currently sits in the “neutral” zone after weeks of mild greed. This shift reflects reduced enthusiasm rather than outright panic.

Market commentators say that investor fatigue may be setting in after months of price swings and regulatory uncertainty. The absence of a clear bullish catalyst, such as an ETF approval or major corporate adoption, has contributed to the slower pace.

However, history suggests that such periods often precede renewed momentum. Consolidation phases allow overextended traders to exit while stronger hands accumulate. When sentiment stabilises, liquidity typically returns, setting the foundation for the next rally.

Exchange Activity and Liquidity Trends

Exchange order books reveal lower depth, meaning that fewer large buy and sell orders are available to absorb shocks. This thin liquidity environment can amplify short-term volatility and create opportunities for algorithmic traders to exploit price gaps.

Binance, Coinbase, and OKX all reported modest declines in trading volume compared with September. However, smaller regional exchanges in Asia and Latin America are seeing increased participation, suggesting that trading activity is redistributing geographically rather than disappearing.

In derivatives markets, open interest in Bitcoin and Ethereum futures remains elevated, but new leverage positions are forming at a slower rate. This cautious stance aligns with the broader theme of consolidation.

Analysts Call for Perspective

Experts urge traders to maintain perspective. “A three percent dip in a trillion-dollar market is not a crisis,” noted economist Thomas Levy from the European Financial Review. “Crypto markets are maturing. Periods of consolidation are essential for long-term sustainability.”

Levy added that lower volume and tighter liquidity are natural responses to macro uncertainty. As central banks clarify their monetary stance and risk appetite improves, capital will likely return.

Others highlight that innovation continues at a rapid pace. Developments in layer-two scaling, tokenised assets, and decentralised identities could drive the next phase of adoption, regardless of the short-term price action.

The Role of Regulation

Regulation remains a key factor influencing liquidity and sentiment. The European Union’s MiCA framework will take effect next year, providing clarity on stablecoin issuance and exchange operations. In the United States, lawmakers continue to debate taxation and reporting rules for digital assets.

While some investors fear stricter oversight, most analysts believe regulation will ultimately boost confidence. Clear rules reduce uncertainty and attract institutional players who have so far stayed cautious.

Regions such as Singapore, Hong Kong, and the UAE are already leveraging regulatory clarity to attract new crypto businesses, offering a glimpse of what a mature market could look like.

Long-Term Outlook

Despite short-term fluctuations, the long-term outlook for digital assets remains positive. Adoption continues to grow globally, with more companies integrating blockchain into everyday operations. Financial institutions are tokenising assets, governments are exploring digital currencies, and retail participation remains strong in developing economies.

As the global economy stabilises, liquidity is expected to return to the crypto sector. Lower interest rates, improved regulation, and ongoing innovation could reignite the next bull phase.

Investors who maintain a disciplined approach during quiet periods often benefit when momentum resumes. The key lies in focusing on quality projects, maintaining diversification, and managing risk effectively.

The decline of the global crypto market cap to $3.78 trillion and the drop in trading volumes mark a cooling phase after months of intense activity. It reflects caution, not collapse. Traders are regrouping, institutions are observing, and the industry continues to evolve beneath the surface.

This consolidation period may prove healthy in hindsight. By allowing the crypto markets to reset and liquidity to rebuild, it creates the conditions for more stable growth in the future. For long-term participants, patience and perspective remain the best strategies in a market that constantly balances innovation with uncertainty.

Crypto’s story has never been linear. It moves in cycles of enthusiasm and reflection, and this moment is simply the quiet before the next wave of change.

Create An Unparalleled Trading Experience

At Wisuno, we deliver a secure, transparent, and innovative trading environment backed by trusted regulation, giving you confidence at every step.

Office 12, 3rd Floor, IMAD Complex, Ile Du Port, Mahe, Republic of Seychelles

support@wisunofx.com