Western Union Enters the Blockchain Era with Solana Stablecoin Launch

The world of money transfers is undergoing a transformation as Western Union, one of the oldest names in financial services, announces its entry into blockchain technology. The company has confirmed the launch of a US-dollar backed stablecoin on the Solana blockchain, a move that positions it at the forefront of digital payments innovation.

For over 170 years, Western Union has been synonymous with cross-border remittances, connecting millions of families across continents. Now, by embracing blockchain technology, it signals that the future of global payments lies not in banks or wire transfers but in decentralised, real-time networks.

Industry analysts describe the decision as a milestone for both crypto and traditional finance. It demonstrates that the barriers between these worlds are dissolving and that established financial giants see blockchain not as competition but as the next logical evolution of their infrastructure.

A Landmark Moment for Global Finance

Why Solana?

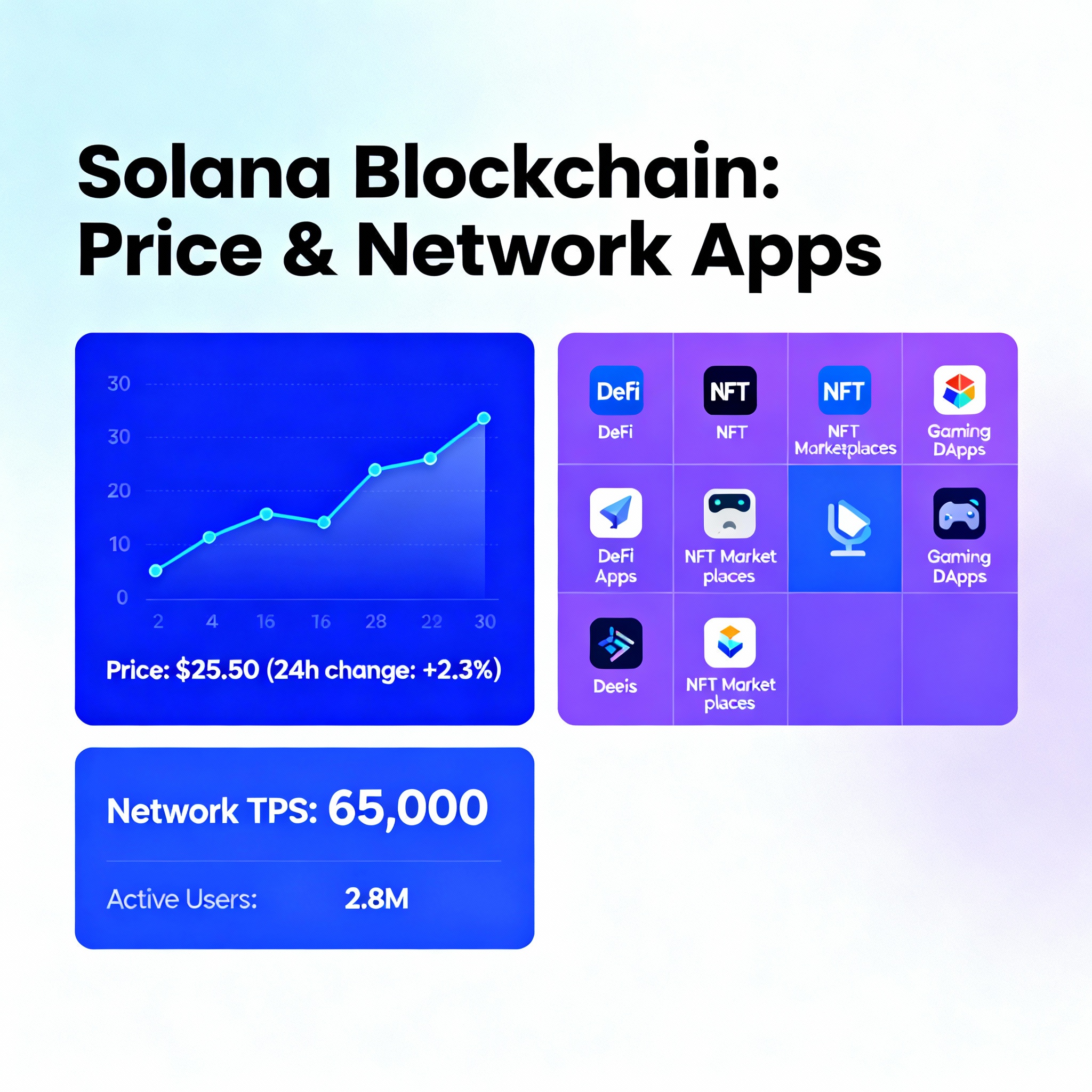

Western Union’s choice of Solana was deliberate. Known for its lightning-fast transaction speeds and low fees, Solana has emerged as one of the most scalable and energy-efficient blockchain networks. The platform can process thousands of transactions per second at a fraction of the cost of older networks like Ethereum.

This technical advantage makes it ideal for remittances, where users expect low fees and instant settlements. For Western Union, which handles billions of dollars in international transfers every year, Solana’s performance and growing ecosystem provide a perfect foundation for its first major crypto integration.

Solana’s expanding developer community and institutional partnerships also add credibility. By choosing a blockchain with proven reliability, Western Union aims to avoid the congestion and cost issues that have plagued other networks.

The Western Union Stablecoin

The new digital asset, informally dubbed WUUSD, will be pegged 1:1 to the U.S. dollar and backed by reserves held in regulated banks. According to company representatives, users will be able to send and receive the stablecoin through the Western Union app or at participating agents worldwide.

Transfers will settle within seconds, compared to the hours or days typical of traditional systems. Recipients can either hold the token in a digital wallet, convert it into fiat currency, or use it for on-chain payments with participating merchants.

Each transaction will carry minimal fees, which is a major advantage for migrant workers who often lose significant portions of their income to high remittance costs. Western Union estimates that the new system could cut average fees by 60 percent for cross-border payments.

A Turning Point for Traditional Finance

Western Union’s move reflects a broader shift in how legacy institutions view crypto. For years, the industry treated blockchain as a risky innovation associated with speculation and volatility. Major players now realise that technology can modernise their operations and expand their customer reach.

By issuing its stablecoin, Western Union joins a growing list of payment giants such as PayPal, Visa, and Mastercard that are experimenting with blockchain integration. However, Western Union’s advantage lies in its existing global footprint, especially in emerging markets where access to banking is limited but mobile phone usage is widespread.

Analysts believe that if successful, this project could set a new benchmark for financial inclusion, allowing millions of unbanked individuals to participate in the digital economy.

Bridging Old and New Economies

One of the most remarkable aspects of the WUUSD initiative is how it bridges traditional cash-based services with digital innovation. Western Union plans to integrate its blockchain-based system directly into its agent network.

At physical branches, customers can deposit cash, instantly converting it into stablecoins and sending it to recipients abroad. On the other side, recipients can either withdraw cash in their local currency or keep the tokens for digital use.

This hybrid approach solves one of the greatest challenges of crypto adoption: accessibility. Many users in developing countries still rely on cash and may not have access to digital wallets. Western Union’s model brings the blockchain to their doorstep without requiring technical expertise.

Partnership Ecosystem and Technical Structure

The project involves several high-profile partners. Western Union collaborated with Circle, the issuer of USDC, to ensure robust reserve management and regulatory compliance. It also collaborated with Solana Labs to optimise network performance for high-frequency transactions.

Security is another cornerstone of the design. All transfers are executed through smart contracts that ensure transparency and immutability. Users can verify their transactions on-chain, giving them confidence that funds are delivered as promised.

To facilitate onboarding, Western Union is introducing a simplified wallet interface that integrates directly with its app. This allows even non-crypto users to send digital payments without worrying about private keys or blockchain jargon.

The Bigger Picture: Crypto Meets Compliance

Western Union’s stablecoin launch also highlights the evolving regulatory landscape. For years, global regulators viewed stablecoins with suspicion, citing concerns about money laundering and financial stability. But as rules become clearer, large corporations are finding ways to innovate within compliance frameworks.

In the United States, Western Union is operating under state-level money transmitter licenses and federal oversight. In Europe, it has aligned with the Markets in Crypto Assets (MiCA) regulation, ensuring that reserves are transparent and auditable.

By proactively complying with global standards, the company positions itself as a model for responsible innovation. This may also give regulators confidence that blockchain can coexist with established financial systems without compromising security or consumer protection.

How This Impacts the Crypto Industry

Western Union’s entry into blockchain payments could have wide-reaching effects. First, it validates stablecoins as a legitimate tool for real-world finance. For years, stablecoins were viewed primarily as on-ramps to crypto exchanges. Now, they are becoming integral to cross-border commerce.

Second, it forces banks and fintech companies to modernise. Institutions that once dismissed blockchain as a fad must now confront the reality that competitors are using it to gain efficiency and reduce costs.

Third, it creates new opportunities for Solana, which stands to gain from increased network activity and institutional partnerships. Analysts expect daily transaction volumes on Solana to grow significantly as Western Union’s rollout expands.

A Win for Emerging Markets

Developing nations stand to benefit the most from this innovation. Many families depend on remittances for survival, but traditional channels often impose high fees or require intermediaries. Blockchain eliminates many of these obstacles by enabling peer-to-peer transactions.

We expect countries like the Philippines, Nigeria, India, and Mexico to be early adopters of the WUUSD system. These regions are already equipping Western Union agents with digital infrastructure to manage blockchain transactions.

In these markets, where local currencies are volatile, dollar-backed stablecoins can offer a more reliable store of value. For users, this means faster access to funds, lower conversion costs, and increased financial autonomy.

Competition and Market Reactions

The announcement has attracted attention. Competitors such as MoneyGram and Wise have already hinted at launching their blockchain integrations. Fintech startups are also exploring how to combine DeFi tools with remittance services.

Crypto markets reacted positively to the news. Solana’s native token (SOL) rose by more than five percent following the announcement, while stablecoin-related assets such as USDC and USDT saw minor upticks in on-chain volume.

Investors interpret Western Union’s move as another signal that blockchain is entering the mainstream. It strengthens the belief that utility and adoption, not speculation, will propel the next phase of crypto growth.

Industry Experts Weigh In

Industry leaders have praised the decision as visionary. “Western Union has just bridged two worlds that have been separated for too long,” said Laura Cheng, Head of Digital Strategy at Wisuno. “It shows that blockchain is not just for tech enthusiasts or traders but for everyday people sending money to their families.”

Others point out that the integration may push regulators to accelerate frameworks for global stablecoin interoperability. “We are moving toward a future where all remittance platforms will need to connect through blockchain networks,” commented Thomas Levy, a fintech analyst at European Payments Review.

Even cryptoskeptics acknowledge its significance. By bringing blockchain into the mainstream remittance sector, Western Union has validated years of experimentation across the crypto space.

What It Means for the Future of Payments

The launch of WUUSD represents a new chapter in financial history. If successful, it could redefine how people send and receive money globally. Over time, blockchain-based payments could replace legacy systems like SWIFT, which are slow and expensive.

It may also inspire a new wave of innovation in DeFi (Decentralised Finance) and CeFi (Centralised Finance) collaboration. Financial institutions could use smart contracts to automate settlements, compliance checks, and currency conversions, cutting costs across the board.

For consumers, the experience will feel seamless. Sending money abroad may become as easy as sending a text message, with transactions completed in seconds and near-zero fees.

Challenges Ahead

Despite the excitement, challenges remain. Stablecoins are still subject to public scepticism and regulatory risks. Critics question whether corporate-issued tokens can remain fully transparent and whether blockchain networks can handle the massive volumes generated by global remittances.

There is also the question of user education. Millions of Western Union customers are not familiar with digital wallets or private keys. The company must invest heavily in training and outreach to ensure users understand how to protect their funds.

Finally, competition from new blockchain-native companies could intensify. Projects like Stellar, Ripple, and Worldcoin are developing their own solutions for cross-border payments. The Western Union will need to continuously innovate to stay ahead.

Western Union’s launch of a Solana-based stablecoin marks a defining moment for both the company and the global financial system. It bridges the gap between traditional banking and blockchain innovation while giving millions of people faster, cheaper, and more inclusive access to money transfers.

This step may ultimately reshape the landscape of global finance. What began as a telegraph company in the 19th century is now leading a digital revolution in the 21st. Western Union’s embrace of blockchain technology proves that even the most established institutions can evolve with the times.

For crypto enthusiasts, it is a validation of everything blockchain promised. For the world’s unbanked, it may be the beginning of true financial empowerment.

Create An Unparalleled Trading Experience

At Wisuno, we deliver a secure, transparent, and innovative trading environment backed by trusted regulation, giving you confidence at every step.

Office 12, 3rd Floor, IMAD Complex, Ile Du Port, Mahe, Republic of Seychelles

support@wisunofx.com